Ask the readers: Can you use positive reinforcement to train smart money habits?

Most of the time, I can sit down and write a blog post in an hour or two. Or three. I get an idea, then pick up my laptop, find a quiet spot, and hack out my thoughts.

Some articles, however, take months (or years!) to create. This is one of them.

You see, near the end of our RV trip across the U.S., Kim and I picked up a puppy. While visiting my cousins near Tahlequah, Oklahoma -- the end of the Trail of Tears and the setting for Where the Red Fern Grows -- we bought one of their hound dog mutts. Naturally, we named her Tahlequah (TOWEL-uh-kwah). From the start, we've been in love with her. She's SO CUTE!

Book review: The Simple Path to Wealth

Yesterday, my pal Jim Collins dropped me a line. "The audio version of my book just came out," he told me. "Audible is letting me give away some free copies. Do you think your readers would be interested?" I do think so! Plus, this is a perfect opportunity to migrate my review of The Simple Path to Wealth from Money Boss to Get Rich Slowly. At the end of this article, I'll explain how you can get a copy of Jim's audiobook, if you're interested (and lucky).

During late July 2015, we stopped for a few days on the Wisconsin side of Lake Michigan. My friend Jim Collins had invited us to spend some time at Shamba, the waterfront vacation home that belongs to his sister-in-law. For several days, we sipped wine and walked in the surf with Collins and his wife. We also talked about work. (I had just begun formulating plans for Money Boss; Jim was writing a book.)

Visualizing your net worth — and how it compares to others

As you all know, I'm fond of financial scorecards. While admitting their limitations, I like numbers and tools that allow you to compare your financial progress with other people.

I like credit scores, for instance, because they put a number on how you handle money -- a number you can compare to Americans at large. And I like apps like Credit Sesame, which let you to monitor your credit score -- much like a bathroom scale lets you monitor your weight.

Perhaps my favorite number is net worth, the total value of everything you own. Calculating net worth is easy. It's what you own minus what you owe. That's it. Simple, right? Simple but powerful.

Winter is coming! How to prepare for the next recession BEFORE it arrives

Yesterday I wrote about why it's important to prepare for an uncertain future. It's tough to predict where we'll be (and who we'll be) in five or ten years. It's even tougher to predict what's going to happen in the world around us. In order to cope with this uncertainty, it's important to be adaptable -- and to prepare for the worst (while expecting the best).

I was reminded of this advice again this morning as I read several articles in a row about the insane rise of Bitcoin and the current bull market in stocks, which is one of the longest in U.S. history.

Here's a graph of the rise of the S&P 500:

Avoiding the fate of the dodo: How to prepare for an uncertain future

Our financial decisions are based on our expectations for the future.

We save for retirement because we expect we'll live a long time in old age, a period where we expect to be relatively unproductive. We invest in stocks because we expect the market to provide outsized returns when compared to other asset classes. We set aside emergency savings because we expect that bad things will happen -- if not tomorrow, then next week (or next year).

We base our expectations on past experience -- both our own experience and the experiences of others.

How we watch TV without cable (and how much it costs)

One of the main reasons Kim and I decided to move from our condo to this quiet country cottage was to save money. We were spending far too much living in the city.

Simply moving made a huge difference to our budget. But now that the dust has settled, it's time for us to look at other aspects of our spending to see where we can save. As part of that, I've been reviewing our recurring expenses to see what I can cut. Yesterday, I canceled our subscription to The New York Times (savings: $5/week or $260/year). Today, I'm reviewing how much we spend on TV and movies.

Cutting the Cord

Visualize your budget flows with a Sankey diagram

There's a new fad in the financial independence subreddit, one that might be fun for Get Rich Slowly readers to play around with. People have discovered Sankey diagrams, a type of chart that makes it easy to visualize data flows. That sounds sort of geeky, I know, so it's probably best to show an example. Or four.

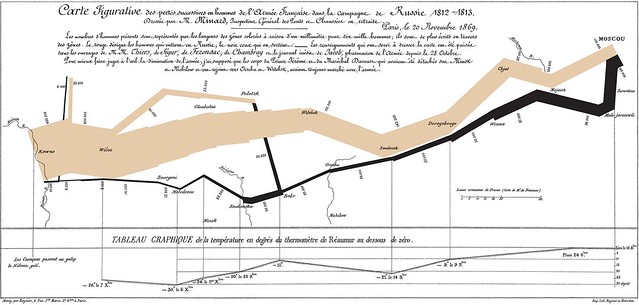

Perhaps the most famous example of a Sankey diagram (certainly the example I've seen most often) is Charles Minard's map of Napoleon's disastrous invasion of Russia:

Your money blueprint — and how it shapes your world

A few years ago, I had a memorable dinner with two friends from high school. Tom, Paul, and I shared good wine, good food and, especially, good conversation. We spent a lot of time talking about how we perceived money when we were younger, and about how these "money blueprints" shaped us as adults.

Tom's family was poor. They lived in a single-wide mobile home. His father built bar stools in the garage; his mother waited tables. Because there was no room inside the trailer house, Tom's family slept outside in tents. And because his father's business never made much money, his mother learned to pinch pennies. She was a queen of thrift.

"I didn't learn much about money from my mom and dad," Tom said as he sipped his wine. "I learned more from Paul's parents. I remember going over to his house and marveling that he had opened a savings account. I remember that passbook you had, and how your parents would drive you into town to make deposits. I went home and told my mom that I wanted a savings account, but it never amounted to much."

Ask the readers: How do you know when your car is dead?

Earlier this month, I shared a link to a comprehensive guide to certified pre-owned vehicle programs. In doing so, I mentioned that Kim and I both believe that you should drive a car until it dies. This prompted a great question from Tired Scientist in the comments. She wrote:

Exactly what is the definition of "until it dies"? My husband and I have gone around and around on this question ourselves. We both believe in driving a car "until it dies", but disagree slightly on the definition of this–because, unlike with the human body, almost all problems on a car are fixable given enough money.

[...] Continue reading...

More about...TransportationShaquille O’Neal once spent $1,000,000 in a single day

Continue reading...Think you've made some poor financial decisions before? Have you ever spent one million dollars in a single day? That's what former NBA star Shaquille O'Neal did -- before becoming a pro basketball player.

https://www.youtube.com/watch?v=wMpZgt6agpU

I go buy a $150,000 car. No negotiations. I don't know nothing about negotiations. The guy could have told me $200,000 and I would have bought it. I go and get a black Mercedes because that's what I always wanted: a black Mercedes and some nice wheels.

More about...Shopping