How mutual fund fees can cost you big bucks

Robert Farrington from The College Investor recently went to bat for one of his readers. "I feel like my advisor isn't steering me in the right path," his reader told him. "When I mention [index funds] to him, he changes the subject or diverts to other topics."

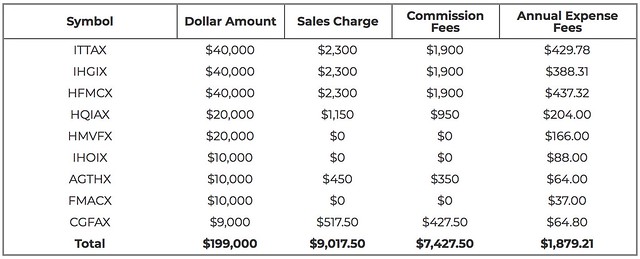

Farrington ran the numbers and discovered that his reader's financial advisor stood to gain $7247.50 in commissions by recommending expensive mutual funds. But that's not all. "When you add in the expense ratio, this portfolio is costing the investor $11,004.71 in year one," Farrington writes. "And potentially costing the investor $1,879.21 or more per year after!" (And that doesn't include any commissions and fees created by rebalancing the portfolio periodically.)

What was life like during the Great Depression?

Since the Great Recession of 2008 and 2009, there have been a lot of news stories about how awful everything is. Never mind that most Americans enjoy the best standard of living of any culture in history, people still find things to complain about. Perhaps this is because people lack perspective. They don't realize what life was like in the past or what real hardship is.

The always-excellent Reading Through History channel on YouTube has a seven-minute video that takes us on a tour of what like was like for the typical American family during the Great Depression.

https://www.youtube.com/watch?v=gkAfjRolNCI

Books about money that might make appropriate Christmas gifts

"My brother sucks with money," a friend told me the other day. "I'm thinking of giving him a book about money for Christmas. Do you have any recommendations?"

"Honestly, I'm not sure gifting a book about money is the best way to help," I said. "I know you mean well, but from my experience this sort of gift has the potential to create hard feelings rather than help. Sometimes it creates resistance rather than acceptance."

"But didn't you get started with your financial turnaround because people gave you books about money?" my friend asked.

How to prevent identity theft (and: What to do if you’re the victim of identity theft)

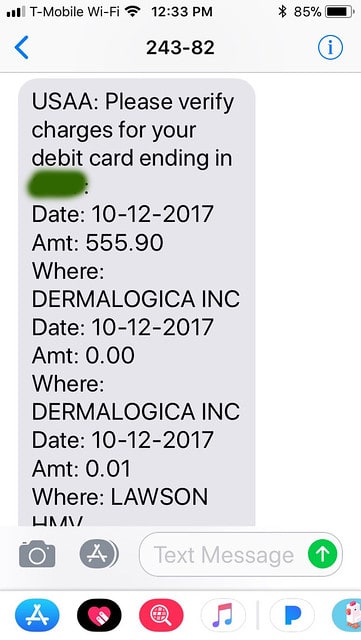

The thief first tried a couple of test transactions for amounts of $0.01 and $0.00. (How is a $0.00 transaction even possible? I have no idea.) When those worked, she went all-in. She charged $555.90 to the account.

Fortunately, Kim has an excellent bank. USAA both phoned and texted to let her know something seemed suspicious. Then, over the next week, they worked with her to keep disruptions as minimal as possible.

There are pros and cons to everywhere

Kim and I moved to our new home in West Linn on July 1st. Although we're only 8.5 miles (and about twenty minutes) from the condo we owned in Portland, I haven't been back to our former neighborhood since we moved. Yesterday, I decided to spend a few hours hanging out at some of my old haunts.

I stopped at the "pot shop" to pick up some sleeping aids. I bought Tally new chew sticks from the pet store. I spent half an hour browsing at the used book store for sci-fi classics. And I stopped to drink a glass of wine at the bottle shop. It was fun to be back in Sellwood once again, if only for a few hours.

While I was sipping my pinot noir, a friend came in. "It's good to see you," she said. "How's life in the new house? Do you miss Sellwood?"

A comprehensive guide to certified pre-owned vehicle programs

Kim and I have been talking a lot about cars during the past few months.

She drives a 1996 Honda Accord with 226,000 miles on it. The car runs fine and has served her well, but she's begun to think about the possibility of upgrading.

I still drive my beloved 2004 Mini Cooper, but the little guy has had some issues lately. (Right now, it's in the shop because the clutch burned out. In the process of replacing that, the mechanic discovered that the transmission needed to be replaced -- thanks to towing the car behind our RV for 15 months.)

The difference between investing and speculation (or: The problem with Bitcoin)

Hold onto your hats, folks. It's rant time!

Based on what I'm hearing on Facebook, Twitter, and in real life, it's time for a refresher course on the difference between investing and speculation. Although these two concepts share some commonalities, they're very different things.

Let me start by telling a story, one I've told many times before. It's the story of the worst "investor" I've ever known: me.

The evolution of retirement

If I were to go back to school, I think I'd study retirement. That probably sounds boring to some of you, but I find the subject fascinating. No joke: My bedtime reading lately consists of books like A History of Retirement by Wiliam Graebner.

You see, retirement is a relatively recent concept. It's only really possible in wealthy nations with long lifespans. In 1880, over 75% of American men older than 64 remained in the workforce. They wanted to work. Work was evidence of vitality and productivity. It gave people purpose. Plus, most folks needed the money.

One hundred years ago, retirement was considered undesirable, something to be avoided. A 24 January 1903 article in the Saturday Review summed up the prevailing attitude: "Men shrink from voluntarily committing themselves to an act which simulates the forced inactivity of death."

How to stay rich when you win the lottery

Jason Butler at The Financial Times shares the story of Roger and Lara Griffiths, the couple who won £1.8 million ($2.76 million) in the U.K.'s National Lottery in 2005.

Instead of using the windfall to buy themselves financial freedom, eight years later the Griffiths found themselves with only £7 in the bank.

Your lifetime wealth ratio (and how to calculate it)

While browsing money blogs yesterday, I came upon an old article from my pal Joe at Retire by 40. The post is from 2015, but it contains a cool concept that I think might be useful for readers of Get Rich Slowly.

Joe -- who was inspired in turn by J. Money at Budgets Are Sexy -- asks, "What's your lifestime wealth ratio?" According to Joe and J. Money, your lifetime wealth ratio is result of a simple equation:

Lifetime Wealth Ratio = Your Net Worth / Your Lifetime Income