What early retirement was like in 1957 (according to Life magazine)

Sometimes I hit the jackpot in my quest to find old material about retirement and early retirement. Last week, for instance, I was reading Early Retirement Dude's history of the financial independence movement when he mentioned a Life magazine photo essay about early retirement from February 1957. Say what?

Within minutes, I was reading the article via Google Books. Within an hour, I had ordered not just that issue of Life but three others with retirement articles. Within days, the magazines were on my doorstep. I'm telling you: We live in the future!

How to retire young

While browsing Oregon's best used bookstore earlier this year, I stumbled on a 1989 book called How to Retire Young by Edward M. Tauber. Tauber retired at the age of 43 from a tenured full professorship as Professor of Marketing at the University of Southern California. He's written a number of marketing textbooks, but this was his first (and only?) foray into the realm of personal finance.

How to Retire Young is one of the oldest books I've found on the subject of early retirement. It's fun to see how much of the modern financial independence movement is foreshadowed in the book's pages.

Is your home a better investment than the stock market?

I'll admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved.

Perhaps this is technically true, but now and then -- as this morning -- I'm reminded that teaching people about money is a never-ending process. There aren't a lot of new topics to write about, that's true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, there's a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes it's not.)

Here's an example. This morning, I read a piece at Slate by Felix Salmon called "The Millionaire's Mortgage". Salmon's argument is simple: "Paying off your house is saving for retirement."

Saving more and working longer: Two powerful ways to increase your retirement resources

The July 2018 issue of the AAII Journal -- the monthly publication of the American Association of Individual Investors -- includes an intersting article about how to "increase your retirement resources". This plain English piece summarizes some of the findings from the authors' research paper "The Power of Working Longer".

According to the article, there are three primary factors that determine "the adequacy of retirement resources". Those are:

- When a person begins participating in an employer-sponsored saving plan,

- What percentage of their earnings they save in such a plan (i.e., their saving rate), and

- At what age they retire and begin taking Social Security benefits.

Until Elon Musk invents a time submarine, it's impossible for a worker to go back to their youth and begin saving for retirement earlier. Because of this, the authors focused their research on the relative power of saving more and working longer.

Passive income vs. passion income

Continue reading...The four-percent rule for safe withdrawals during retirement: Theory versus reality

Last week, I wrote about the problem with retirement spending: How much should you spend during retirement? If you spend too much, you run the risk of depleting your savings. But if you spend too little, you're sacrificing the opportunity to make the most of your money, to "drink life to the lees".

One of the guiding principles in retirement planning is that there's a "safe withdrawal rate", a pace at which you can access your investments so that your nest egg will last for thirty years (or longer).

For simplicity's sake, a lot of folks talk about the "four-percent rule": Generally speaking, it's safe to withdraw 4% from your investment portfolio every year without risk of running out of money. (This "rule" manifests itself here at Get Rich Slowly when I say that you've reached Financial Independence once you've saved 25x your annual spending -- 33x your annual spending if you want to be cautious.)

How much should you spend in retirement?

That said, I've noticed that a lot of retirees -- early retired or otherwise -- struggle to know how much they should spend. I believe this dilemma exists for a couple of reasons:

- First is the life expectancy problem. You don't know how long you're going to live. If you did know the precise date of your death (or even the year of your death), retirement planning would be much easier. You'd be able to say, "Okay, I have ten years left and $300,000 in the bank. Based on that, I should be able to spend $30,000 per year." But you don't know when you're going to die, so a lot of retirement planning becomes guesswork.

- Second is the question of what your money is for? Do you want to leave a legacy for your children (or somebody else)? Do you want to maintain a chunk of change for possible end-of-life medical issues? Or do you want to use your wealth to live life to the fullest while you can? In my case, my ideal would be to die broke. If I could spend my very last penny on the last day of my life, that'd be perfect.

The general response to these two problems is to follow what has been dubbed the four-percent rule. Generally speaking, it’s safe to withdraw 4% from your portfolio every year without risk of running out of money. (There are a lot of caveats to this guideline. To learn more, follow that link to my Money Boss article -- or wait for that story to migrate to Get Rich Slowly in a few days!) Continue reading...

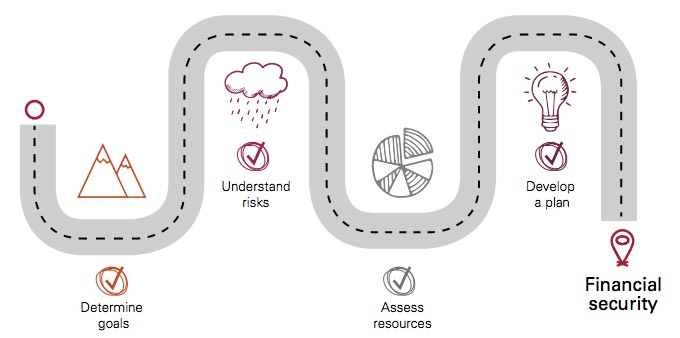

Free retirement planning guide from Vanguard

Vanguard, the mutual fund company, recently published a free retirement planning guide for folks like me who aren't interested in hiring a professional financial advisor. Vanguard's Roadmap to Financial Security is a 32-page document intended to provide DIY investors with a framework for decision-making in retirement.

Here's an excerpt from the intro to this retirement planning guide:

Cashing in on the American Dream: How to retire at 35

All his life, Paul Terhorst wanted to be rich. Even in grade school, he looked forward to having a corporate job, to joining the world of big business. "I didn't just dream about money and power and expense account living -- I planned for it." He grew up and made it happen.

He got his MBA from Stanford. He became a certified public accountant and joined a large accounting firm. At age 30, he became a partner in the company. He had "a huge office, a leather chair, and a view of a polluted river". He'd achieved everything he'd always dreamed about.

Fifteen years of semi-retirement: A real-life look at what it’s like to live more and work less

Today's "money story" is an article from Bob Clyatt, author of the outstanding Work Less, Live More, which is one of my favorite books about financial independence and early retirement. [My review.] It's an update on what his life has been like since moving to sem-retirement fifteen years ago.

I had the good fortune to start a digital design firm in 1994. I sold it during the dot-com frenzy, leaving me with a bad case of burnout and full retirement accounts. It seemed like the right time to pull the plug, so in 2001 — at the age of 42 — I left full-time work.

I embarked on a self-funded post-career lifestyle that wasn't quite retirement (at least not in the traditional sense). I chose to do part-time, work-like activity in order to stay challenged and engaged while also closing budget gaps. Five years later, I wrote Work Less, Live More, which popularized the notion of semi-retirement.