The five types of retirement

Turns out, retirement wasn’t always considered desirable (at least not for employees). In the olden days — back in the late 1800s — “mandatory retirement” caused a great deal of resentment among older workers and there was a popular backlash against it. People wanted to keep working, but as big corporations rose to prominence and power, they pushed for a younger workforce.

I haven’t really read enough about the history of retirement to write intelligently on the subject, but I wanted to share a quick observation on the nature of retirement in 2018.

You see, while the idea of retirement might be relatively young, it’s achieved a level of complexity that I find fascinating. Retirement is no longer one thing. It’s many things. Or many possibilities. I thought it might be fun to visualize what I consider the five most common kinds of retirement in our current economy. (Note: Yesterday, we looked at the standard definition of retirement — and how there’s not really any standard definition at all.)

Traditional Retirement

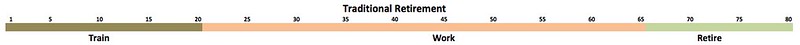

During the 20th century, a standard model of work gained prominence in the United States (and other developed countries). You got a good job, you worked hard for forty or fifty years, and then you retired around age sixty to enjoy the last decade or two of your life. (Your retirement was funded through some combination of company pension, personal savings, and government aid.)

Graphed, the traditional model of work looks like this:

By the 1970s and 1980s, standards of living had risen enough that some folks began to challenge traditional assumptions, even embraced the idea of leaving the workplace.

“Why should we wait until the end of our days to make time to enjoy life?” they wondered. “There’s got to be a better way.”

Early Retirement

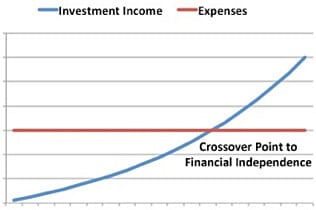

This “better way” turned out to be early retirement. These brave pioneers ran the numbers and demonstrated what would have been an impossibility just a few decades before. If you worked hard to increase your income while simultaneously striving to keep costs low, it was possible to save enough so that you can stop working at fifty. Or 45. Or forty.

Graphed, the early retirement model looks like this:

The key difference between early retirement and traditional retirement is your saving rate.

The traditional retirement model requires a saving rate of 10% (or maybe 20%). The early retirement model requires you to save half your income — or more. If you’re diligent and build a wealth snowball, you’ll eventually reach a “crossover point” (as described in the 1992 classic Your Money or Your Life): The income from your investments will be enough to support your spending. You’ll have reached financial independence.

These two approaches are the most popular paths to retirement, probably because they lead to permanent retirement. Once you stop working, you’re done. To folks still trapped in the Matrix, these might seem like the only options. But I believe there are at least three other types of retirement.

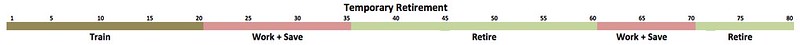

Temporary Retirement

In 1988, Paul Terhorst published Cashing in on the American Dream, one of the first books to explore alternative retirement options. While Terhorst advocated early retirement (as described above), he also explored another kind of retirement, one that we’ll call temporary retirement.

Here’s how the author describes it:

We used to work and then retire. [I suggest] you work, then retire, then consider going back to work. Under this plan you devote your middle years to yourself and your family. During those years your mental and physical powers reach their height. You can explore, grow, and invest your time in what’s most important to you. You can enjoy your children while they’re still at home. Later, after you’ve lived the best years for yourself, you can go back to work if you want to. The choice will be up to you.

Under Terhorst’s plan, you go to work for ten or fifteen years, then you take time off to pursue your passions for as long as your money lasts. This could be ten years or twenty — or it could turn into the rest of your life.

Graphed, the temporary retirement model looks like this:

I haven’t thought much about temporary retirement, but it seems to have some interesting features. For one, you do get to spend your prime years on whatever is important to you. But what I like best is that if you return to work later in life, you ought to have higher earning power and you’ll probably have access to better health insurance. (Finding affordable, quality health insurance is a huge issue for early retirees, especially in the past five years.)

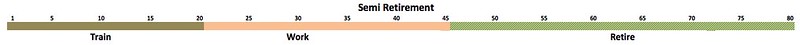

Semi-Retirement

Temporary retirement is one novel approach to leaving the workplace. So too is semi-retirement, which was popularized by Bob Clyatt in his excellent 2005 book Work Less, Live More.

According to Clyatt, semi-retirement is about finding work-life balance. For some, that means continuing with their previous career, but in some sort of reduced capacity. For others, it could mean changing jobs completely to something that pays poorly but offers a sense of satisfaction. And for others, semi-retirement could simply mean supplementing investment income with a care-free job at the local coffee shop or fabric store.

Graphed, the semi-retirement model looks like this:

As I’ve said many times before, I consider myself semi-retired. I’m financially independent, it’s true, but I choose to continue working. Having extra income provides and added layer of security. More than that, however, my work here at Get Rich Slowly (and elsewhere) gives me a sense of purpose.

One of the biggest advantages of semi-retirement is it allows you to leave the rat race at a much earlier age than you might otherwise be able. Even if you’re not ready to quit work entirely, you can opt to find less stressful and/or more fulfilling work. Your financial needs aren’t as great, so you don’t have to choose a job based on income.

Mini Retirements

The last of the five types of retirement comes from Tim Ferriss’ 2007 bestseller, The 4-Hour Workweek. In that book, he asks: “Why not take the usual 20-30-year retirement and redistribute it throughout life instead of saving it all for the end?” With this model, you work in fits and starts. You might work for five years then take two years off — and then repeat the process all over again. Ferriss refers to these career breaks as “mini-retirements”; you might know them better as sabbaticals.

The advantage of using the mini-retirement model is that you’re able to get the best of both worlds — work and retirement — at every age. The disadvantage is that you never really build up a huge buffer of savings because you’re using that money to fund your sabbaticals every few years.

Graphed, the mini-retirement model looks like this:

When I read The 4-Hour Workweek, I felt like Ferriss was vague on how to make mini-retirements happen. Naturally, I dug deeper into the subject when I got a chance to interview him for Get Rich Slowly in May 2008. Sabbaticals and mini-retirements are terrific options for folks who are looking for a non-traditional career path, and who want to take time off to experiment with travel and entrepreneurship while they’re young. (Kim essentially took a mini-retirement while she and I spent fifteen months traveling across the U.S. in a motorhome.)

Which Type of Retirement is Right for You?

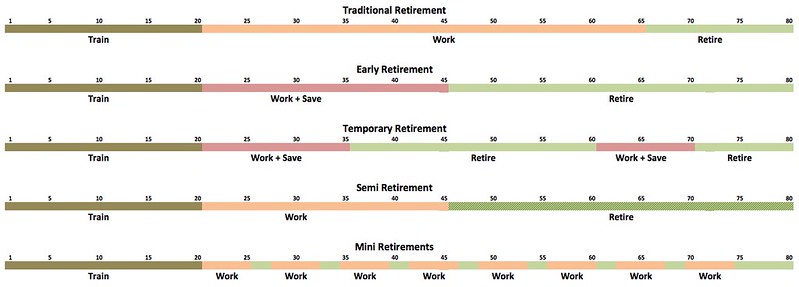

I know those timelines are teensy-tiny, and I apologize. By their nature, they’re long and wide. Plus, it probably doesn’t help that they’re spread throughout the article. In an effort to add clarity, here’s what they look like next to each other. (You can click the image below to see a larger version that might be more readable.)

The brown part of the bar is “training”, the period during which we’re in school as children and young adults. The green part of the bar is retirement. An orange section is work with a traditional saving rate. A red section is work with a high saving rate.

After all this, here’s what’s important to understand: There’s no one right way to retire. Despite what the Internet Retirement Police would have you believe, each of the options I’ve listed here is valid. They’re each a type of retirement. (Still, I try to use the term “financial independence” instead of “retirement” just to avoid confusion — and arguments.)

Which type of retirement is right for you? It depends. Only you can answer that. How’s your health? Do you like your job? How much money have you saved? What’s your purpose? What are your goals? All of these answers will have a bearing on your decision.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)