How to manage money as a couple

As January fades and February blooms, we’re going to turn our attention from basic money management to something much more complicated: how money affects our relationships.

In December 2016, Bloomberg published a piece that profiled seven different couples from around the United States. The article — which was essentially a series of short interviews — offered a quick glimpse at how other people handle money in their relationships.

Here, for example, are Rebecca and Ari discussing what it was like to move in together:

Rebecca: So I moved here to be with him, was broke, and was accepting this big loan. But you were like, “I’d rather you owe me the money than owe the credit card company.” I was really impressed by that but also scared, because it was like, “What if we break up?” It definitely felt fraught. But I did accept the loan.

Ari: I mean, I loved Rebecca, and I just really hate credit card companies.

Rebecca: We had totally different relationships to money. Ari had been saving for retirement since he was, like, 17. He had this whole system of personal finance, and I had: Money comes in, money goes out. I think I felt embarrassed that Ari was this unbelievably responsible person.

Some of the highlighted couples have high incomes — over $100,000 per year. Others are barely scraping by. (One couple makes $24,000 per year; both partners work at Wal-Mart.) Some struggle with debt. Others are saving to pursue entrepreneurial dreams. But they’re all discovering how to navigate the murkiness that can come when two people decide to join households.

Here’s the couple that works at Wal-Mart:

Renée: I get a little frustrated at him. Sometimes I get a little bit surprised that he did that when I told him, “Not right now.” I’ve got anxiety over money. I do.

Matt: I do want to go back to school or get a second job. But what it does to you to work that much, I’m afraid I’d be gone all day. My wife would not see me. By the time I got home, it would be too late at night. I’d be way too tired. Not being able to come home, sit down, and say, “Hey, how was your day?” and all that?

Money management is tough enough when you’re on your own. Throw a romantic partner into the mix and things get more complicated! The best way to balance love and money is to maintain clear lines of communication.

Talking About Money

Reading through these conversations reminded me of a 2009 New York Times article in which Ron Lieber argued that couples need to talk about money early and often. Lieber says that couples should discuss the following four subjects before marriage (or before entering into a long-term commitment):

Ancestry

What does you money blueprint look like? What did your parents teach you about the meaning and value of money? How your family handled money has a huge influence on your own relationship with the stuff. If you and your partner have drastically different approaches to personal finance, that can cause friction.

Credit

It doesn’t sound very romantic, I know, but partners in a committed relationship ought to pull up their credit reports and credit scores together and discuss the results. This isn’t a competition. It’s a way to be open and honest, and to see where your team has strengths and weaknesses.

Control

Before marriage, decide the household financial structure. Who’s responsible for which bills and which accounts? Will you have joint or separate finances? Will one person operate as the Family CFO, or will you share the duties?

Affluence

Finally, be sure to discuss your financial plans and goals. As a couple, how wealthy do you want to be? Are you interested in early retirement? What are you willing to sacrifice to get there?

As you have these discussions, don’t get emotional. Stay calm and collected. Remember that your goal is to manage your household finances like a business. If you, as a couple, don’t like how your business is running, then agree to make changes. But make the decisions together, as a team.

The Importance of Teamwork

You’ll always have some financial goals that don’t align with your partner. That’s fine, but put shared goals first. No matter whether your finances are joint or separate, make sure your common objectives are met before pursuing personal passions. Put the team before the self.

Here are a few ways to ensure that both partners are on the same page and that nobody ends up feeling like the bad cop:

Regularly review accounts

I believe it’s important to set aside a specific time and location to manage your money. Some couples do this weekly. Others do it once or twice a month. At each session, look at upcoming income and expenses, and deal with any unexpected budget items. Regular reviews will keep you headed in the right direction while also allowing for minor course corrections.

Don’t be controlling

Remove “you” and “I” from budget conversations. Replace them with “we” and “us” instead. Each partner needs to feel like they’re involved in the household finances. If you unilaterally tell your husband he can’t spend money on his motorcycle hobby, he’s going to be resentful. If your household is struggling to make ends meet but you won’t let your wife work outside the home, you’re handicapping your budget unnecessarily.

Be supportive

Work together to achieve shared and separate goals. If your husband asks you to call him out on his bad behavior, do it. If he wants advice, give it. But don’t lecture and don’t be condescending. Be a partner, not an adversary.

Play to your strengths

Some folks aren’t interested in crunching the numbers. They don’t care about bank balances, interest rates, or the Dow Jones Industrial Average. Others don’t like the day-to-day nitty-gritty stuff, such as clipping coupons or shopping at sales. Let each partner handle the stuff they’re good at.

It’s rare that a couple will agree completely on how to handle their money. The key is to find as much common ground as possible, and to find ways to compromise on the rest.

Note: It’s vital for both partners to know what’s going on with the household budget. Over the past decade, I’ve heard too many horror stories about what can happen after a partner dies or asks for a divorce. All too often, the other person is left with no clue how to handle the household accounts. (In fact, I think a Money Boss reader is currently working on an article about this very subject.)

Do What Works for You

When I was married, Kris and I kept separate finances. In the 23 years we were together, we never once talked about merging our accounts. For us, for who we were at the time, it just didn’t make sense. This made a lot of my Get Rich Slowly readers tense — they felt as if failing to join finances somehow showed lack of commitment — but the system worked for us. We never fought about money.

I’ve been with Kim for almost six years now. We too keep separate finances, but we’ve also combined money in ways that Kris and I never did. Before our fifteen-month RV trip around the United States, for instance, we created a pooled account into which we could both save. And in our day-to-day lives, we each take care of expenses as we see them without splitting the cost with the other person.

Neither of these methods is better than the other. Each is right for its particular relationship. For me and Kris, it made sense to keep things separate. For me and Kim, it works better to merge some stuff. If I were with somebody else, maybe we’d pool our money completely.

I just don’t think there’s any one right way to do this. The “right” method is the one that works for you and your partner, the one that keeps your relationship strong while allowing you to pursue your purpose.

Your Turn

When I first read the Bloomberg article profiling how couples handle money, I shared it on Facebook. Each person who commented had a different way of handling money in their relationship. Some kept separate finances; others had joint accounts. Mostly, people seem to use some sort of hybrid system.

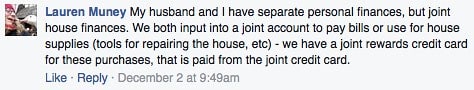

For instance, Lauren and her husband do both joint and separate finances:

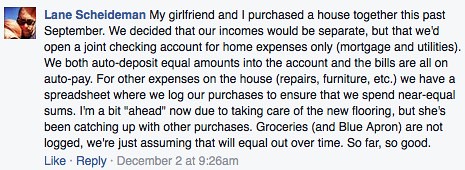

Or there’s Lane and his girlfriend, who also use a sort of combination system:

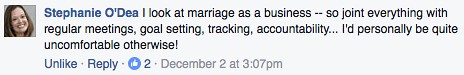

But I think my favorite comment came from Stephanie, who manages the household like a business:

What about you? What system do you use? How did you arrive at this setup? Did you try other systems first? Do you have regular household budget meetings? Do both you and your partner know how to handle your household finances? Do you keep joint accounts or separate accounts? Some combination of the two? What do you wish you did differently?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)