Book review: Meet the Frugalwoods

From time to time, somebody will publish a book like David Chilton's The Wealthy Barber, which provides financial advice in the guise of a story, but these attempts are very, very rare. (It's a bit ironic that one of the oldest, most revered personal finance books -- The Richest Man in Babylon -- is story based, yet few have followed in its footsteps.)

All this is to say: For years, I've believed there's a hole in the market waiting to be filled, a place for a story-based book about money.

5 key retirement factors your financial plan may not address

If you love cat pictures, today is your lucky day. Because I'm back!

As longtime readers will recall, I contributed to Get Rich Slowly from 2009 to 2013. I often wrote about more "technical" (i.e., boring) topics, such as taxes and IRAs. In order to provide a reprieve from the technical-ness, J.D. occasionally sprinkled in cat pictures. I tried not to take it personally.

But for the record, I think other creatures would have been more appropriate. Such as the blob fish.

How I became a millionaire while working in my pajamas

This article was written by the Millionaire Mommy Next Door. At her blog, MMND shares her recipe for success, happiness, and financial freedom. This piece originally appeared on her site in a slightly different format.

When my husband and I married (at age 23), I was working as an office assistant at a veterinary hospital earning $7.50 per hour. Unsatisfied with my low wages, I brainstormed ways to generate extra income.

Going to the Dogs

I had worked as a volunteer dog-trainer for the Humane Society since age 14, so I combined my experience and youthful exuberance into a part-time side business. I offered dog-training classes and taught them in the veterinary hospital's backyard. It was a win-win situation: my employers had a new service to offer their clients, and I was self-employed, with very low operating expenses.

Time is more valuable than money

It's a GRS tradition! Each year on Halloween, I publish a story about planning for death. Usually these are general articles about estate planning. This year's story is personal.

When my best friend died in 2009, one of my biggest regrets was that I hadn't made time to travel with him.

Sparky had previously asked me to join him on trips to Burning Man (in 1996) and southeast Asia (in 1998) and Mexico (in 2003). I'd declined each invitation, in part because I was deep in debt but also because I thought there'd be plenty of time to do that sort of thing in the future.

Becoming proactive: The number-one secret to wealth, freedom, and happiness

A few weeks ago, I cataloged the difference between successful people and unsuccessful people. Based on my reading (and personal experience), I compiled a list of 61 habits that foster wealth and success.

While writing that article, I found one critical difference was mentioned again and again. Every author and expert on the subject shared some form of the following. Generally speaking: Successful people believe they control their destiny and unsuccessful people do not.

In Secrets of the Millionaire Mind, for instance, T. Harv Eker lists seventeen ways the financial blueprints of the rich differ from those of the poor and middle-class. Number one on his list?

Romanticizing poverty and learning financial independence

In high school, I babysat a kid whose parents were pretty well off. And by "well off," I mean they were crazy rich.

One day I decided to take the kid out for ice cream -- my treat. When we got to the ice cream shop, I only had enough money to buy him the small, and he wanted the large. What then followed wasn't exactly a temper tantrum; it's probably better described as a communication breakdown. He was legitimately confused as to why he couldn't have the larger size.

He truly couldn't understand the concept of "not enough money." Price was not a matter of quantity to him, but simply a choice -- it was like asking whether he wanted vanilla, strawberry or chocolate. The idea that his options were limited because of cost was beyond him. He also didn't understand that I was treating him. From his perspective, the ice cream was always there for him to begin with -- it didn't matter who happened to be forking over the money.

The power of non-monetary investments

The Get Rich Slowly summer of books continues! Today's excerpt comes from Jordan Grumet, better known in the FIRE world as Doc G, host of the Earn & Invest Podcast. When he's not talking about money, Jordan is a real-life hospice doc. His new book, Taking Stock, offers lessons from the dying to the living.

The following is from Taking Stock by Jordan Grumet with permission from Ulysses Press. Copyright © 2022 by Jordan Grumet. This passage has been edited to be more readable on the web.

How I built my own house — without a mortgage

This article written by Ian is part of the "reader stories" feature at Get Rich Slowly. It's the extended version of the story he shared in his prize-winning entry to this year's GRS video contest. Some reader stories contain general advice; others are examples of how a GRS reader achieved financial success — or failure. These stories feature folks from all levels of financial maturity and with all sorts of incomes.

It dawned on me in college, having experienced several different summer jobs, that I really didn't like being employed. Sure, the money is nice — but it's just no fun at all to spend your days working to reach some boss's plans or goals. I'm sure there are some folks out there who find a 9-to-5 job fulfilling, but that sure ain't me. There's too much fascinating stuff out there to learn and do to spend 40 years in a cubicle. The mere thought makes me shudder, and I wanted nothing to do with a career.

Most of the financial advice out there is geared towards building up a big account to retire on. I figured that I would enjoy taking a different route — reducing the total income I needed to live on. With a significant reduction in expenses, it becomes feasible to live very comfortably on a part-time income, or even just income from hobbies. How do you reduce your expenses that much? Live off the grid.

<The New Graduate’s Guide to Financial Freedom

I graduated from college in 1991 with a degree in psychology and a minor in English lit. I was one course shy of a second minor in speech comm. With credentials like these, it's no surprise that my first job out of school was knocking on doors, selling crummy insurance to little old ladies in Eastern Oregon. I hated the job, but I could not quit. I was trapped by debt.

After I was hired, I had gone a little crazy. Because I would soon be earning a steady income, I figured it was safe to spend some of my future earnings. My car — a silver 1983 Ford Escort — was a piece of junk. I didn't think it made sense to repair it. Fortunately, the bank gave me a loan for a new car. I bought a 1992 Geo Storm. Then, using credit cards, I bought an entire wardrobe of business attire and a Super Nintendo. "It's okay," I kept telling myself. "I have a job. I'll be able to pay for this."

Why don’t Americans save?

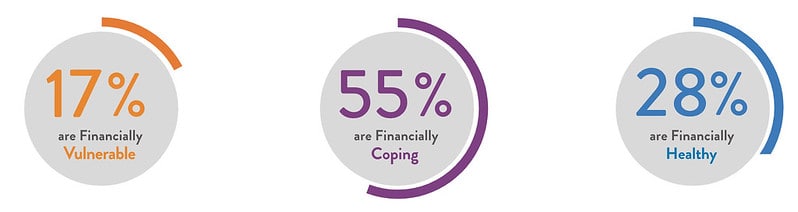

A new report from the Center for Financial Services Innovation says that only 28% of Americans are financially healthy. And it reinforces something we already knew: The U.S. saving rate sucks. Americans don't save.

The U.S. Financial Health Pulse divides people into three tiers of financial health.

- Financially healthy people (28% of the U.S., 70 million people) are "spending saving, borrowing, and planning in a way that will allow them to be resilient and pursue opportunities over time."

- Financially coping people (55%, 138 million) are "struggling with some, but not necessarily all, aspects of their financial lives."

- Financially vulnerable people (17%, 42 million) are "struggling with all, or nearly all, aspects of their financial lives."