Earning, spending, and saving: The building blocks of personal finance

A couple of weeks ago, Robert Brokamp explained how living below your means is like saving for retirement twice. On the surface, his advice was pretty conventional: The more you save today, the more you’ll have tomorrow. This is similar to a point I’ve been repeating for the past five years.

Smart personal finance can be reduced to one simple equation:

If you spend more than you earn, you have a negative cash flow. You’re losing wealth and in danger of going into debt. (Or, if you’re already in debt, you’re digging the hole deeper.) If you spend less than you earn, you have a positive cash flow, which will let you climb out of debt and build wealth.

But as I was editing Brokamp’s article, I had a flash of insight. What Brokamp was trying to say — and what my little equation tries to quantify — is that basic personal finance comprises three essential skills:

- Earning — your ability to bring in money.

- Spending — your ability to live frugally and spend wisely.

- Saving — your ability to produce a surplus and to make that surplus grow.

Some folks are good at one skill, but not the others. (Maybe you’re good at keeping your costs low, for instance, but struggle to earn money.) Other people are good at two of the skills, but fall down on a third.

To be truly successful at personal finance, you have to maximize your performance in all three areas.

Mastering the Art of Earning

The first skill in this framework is your ability to make money. For most folks, this means managing a career effectively: finding the right job, learning how to ask for a raise, and so on. Others can up their incomes by selling stuff they already own, pursuing money-making hobbies, or starting their own businesses.

Here are some steps that lead to increased earning:

- Become better educated. In general, the better your education, the better your income.

- If possible, choose a career that you love — and that pays well. This isn’t always possible, of course. But if you can get paid well to do what you love, it can almost be like you don’t have a job at all!

- Maximize your salary. This is probably your primary source of income, so make the most of it. Learn how to negotiate your salary. Make the most of your benefits.

- Make money from your hobbies. Find ways to earn a little cash from the things you do in your spare time.

- Turn your clutter into cash. When I was getting out of debt, I sold tons of Stuff previously bought on credit. I didn’t get back what I paid for it, but that’s okay. I got out of debt, which was even better. (Here’s more about selling your stuff.)

Though some people don’t like to hear it, high income is also associated with hard work. The folks who make the most money are often those who work the longest hours. Hard work doesn’t guarantee a high income, of course — there are plenty of hard workers stuck in low-wage jobs — but it’s tough to master the art of earning without hard work.

And here’s another reason to enhance your earning power: As vital as it is to cut your spending, there’s only so much you can trim from your budget. Your income, on the other hand, is theoretically unlimited.

If life were a game, your earning score would be easy to calculate: It’d simply be a measure of your annual income. The more you made, the higher your score.

Developing Discipline in Spending

While some people find it tough to boost their incomes, others find it tough to keep costs down. There are even those who believe that thrift is overrated, that it’s somehow akin to deprivation. But those who dismiss frugality to focus solely on earning are missing a key piece of the puzzle. Your goal should be to create as big a gap as possible between earning and spending.

How do you do that?

- Embrace frugality. A lot of folks are afraid to pinch pennies — they don’t want to appear cheap — but frugality is an important part of personal finance. Learn to clip coupons, shop at sales, and make do with less.

- Practice conscious spending. You can’t always get what you want, so decide what’s important to you, and make those things a priority. Cut corners on the things that don’t matter.

- Avoid paying interest. The power of compound interest can help you build wealth when it’s on your side. But it can suck you dry if it’s working against you. To cut your interest payments, Get out of debt and stay out of debt. Make it a goal to pay as little interest as possible.

- Reduce recurring expenses. One-time costs can be painful, but ongoing expenses — like magazine subscriptions, cable television and cell-phone bills, etc. — can act like an anchor on your finances.

- Focus on the big wins. Daily frugality is a valuable skill. It helps you save a little bit all the time. But if you really want to cut your spending, spend less on the big things, like housing and transportation.

If personal finance were a game, your spending score would come from how low you could go. The less you spent, the higher your score.

Remember: Your earning power might bring you wealth; frugality and thrift will help you keep it. By cutting your spending while you increase your income, you’ll develop a cash surplus — a surplus that can be used for saving.

Discovering the Secret of Saving

Often when I write about saving, I’m just talking about the difference between what you earn and what you spend. This surplus is important, no question — it forms the foundation of your ability to save — but skill at at saving comes mainly from what you do with your surplus.

If you hide your money under a rock, for instance, your skill at saving isn’t particularly good. Anyone can do that. And though you might think you’re protecting what you’ve saved, you’re actually losing money to inflation, the silent killer of wealth. (If you use your extra money to play the lottery, I’d argue that your savings skills are especially poor!)

What sorts of things go into becoming a successful saver? This is where a knowledge of investing pays dividends. The secret of saving is to learn everything you can about making your wealth grow. Successful savers:

- Understand the importance of creating a plan — and sticking to it. (This is where asset allocation and re-balancing come into play. I’ll write about these more later in the month.)

- Make logical decisions instead of succumbing to emotion. Successful savers don’t make decisions based on breathless media pundits.

- Avoid fads. They don’t buy real estate just because everyone else is. They don’t buy tech stocks just because they’re riding high. And they’re wary of gold when it’s at record highs. They buy low and sell high.

- Embrace diversification as a way to improve returns while reducing risk.

- Constantly contribute their surplus income to grow their savings. They pay themselves first.

If there were a scorecard for life, your points for saving would be determined by how much you make your surplus grow, and by how well you protect the money you save.

The Fundamentals of Personal Finance

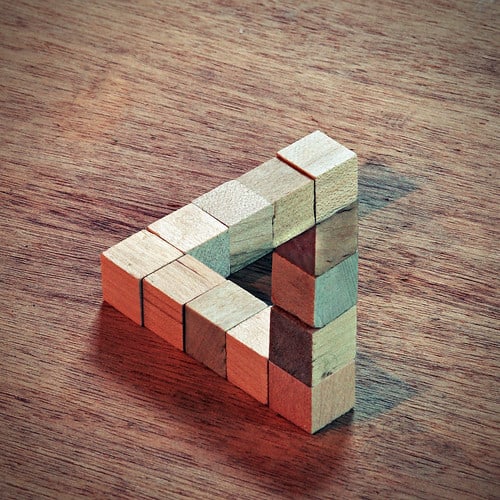

None of this is earth-shattering; these notions form the core of smart personal finance. What is new — for me, anyhow — is thinking of earning, spending, and saving as discrete skills, building blocks that can be put together to form a greater whole. It’s this framework that’s new.

Mastering money means mastering each of these three skills. If you can teach yourself all about earning, spending, and saving — and put what you learn into into practice — you’ll achieve your financial aims with surprising speed. But so long as one of these skills lags, you’ll struggle to meet your goals.

Penrose blocks photo by gfpeck.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)