Financial Balance Lets You Enjoy Tomorrow AND Today

This article is the 11th of a 14-part series that explores the core tenets of Get Rich Slowly. It originally appeared at Soul Shelter in a slightly different form.

For more than a decade, I was buried in debt. My relationship with money was poor. I earned a decent salary, but I couldn’t seem to get ahead. I lived paycheck-to-paycheck on $40,000 a year.

I’d frequently find myself standing in a store, holding a stack of CDs, say, or maybe several magazines. Inside, I’d be arguing with myself, almost as if there were an angel on one shoulder and a devil on the other. Most of the time, the devil won. I’d buy the stack of CDs or the magazines. And I’d use credit to do it. I was a compulsive spender.

Eventually, two friends helped me to realize the path I was on. I began to read personal finance books, I started Get Rich Slowly, and I converted to the “religion” of frugality. I learned to pinch pennies.

This new-found thrift was exactly what I needed. It helped me to get out of debt and to begin building wealth. I even opened my first savings account, and have now built a sizable emergency fund. Best of all, I’m maxing out my retirement savings every year.

Going to extremes

But something happened along the way. As I converted from spendthrift to, well, thrift, my relationship with money changed — but it didn’t improve. I went from a man who spent too much to a man who spent too little.

Again, it took outside intervention for me to realize I had a problem. Last year, I complained about the cost of movies. I complained about the cost of milk. I complained about the cost of hot chocolate. “You’re not being frugal,” GRS readers told me. “You’re being cheap.”

That was a wake-up call. I realized that I was still struggling to develop a healthy relationship with money. I hadn’t achieved balance.

And balance is what’s required. I believe that thrift is a virtue, and I don’t intend to abandon it. But thrift can also be a vice if taken to an extreme. It’s not wrong to spend money on yourself, if you can afford it. Money is a tool, and it should be used to bring us joy, when possible.

The balanced money formula

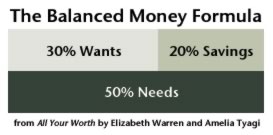

One tool that I’ve embraced for the past year is the balanced money formula introduced by Elizabeth Warren and Amelia Tyagi in their excellent book, All Your Worth: The Ultimate Lifetime Money Plan.

Here’s what it looks like:

As you can see, when your financial life is in balance, you’re allocating enough for savings and needs, but you’re also setting some aside for the things you want. This idea is simple, but it was a revelation to me. No more spending too much on wants, but no more pinching pennies, either.

Since embracing the Balanced Money Formula just over a year ago, I’ve been much happier. It’s a sort of broad non-prescriptive budget the gives me the freedom to spend on my Wants — like comic books and a new bike — as long as I’m taking care of my Needs and setting something aside for Savings. I’ve learned that I can stay frugal in my day-to-day life, but it’s okay to splurge a little on the things I like — including good hot chocolate.

Finding balance

In order to find balance, you’ve got to do some soul-searching. I think of it as a three-step process:

Find what makes you happy

Look inside yourself and ask, “What is it that brings meaning, pleasure, and joy to my life?” Be honest. How can you create a life that features more of the good stuff and less of the mundane?

Focus on your goals

Set personal goals based on the things that make you happy. If you like music, maybe one of your goals could be to learn to play the guitar. If you want to change careers, maybe one goal would be to go back to school. Make meaningful goals a priority, and let the other stuff be secondary.

Seek balance

Strive for moderation in all things. Pursue your goals, but don’t forget frugality. Be frugal, but don’t forget your goals. Work hard to build your financial fortress — but let yourself have a little fun, too.

The quest to achieve financial balance is about more than money. It’s also about meaning. Money is important, yes, but it’s not the only thing. Money is a means, not an end.

Each of us has parts of our lives that feel unbalanced. When we experience this lack of equilibrium, it’s important to do something about it, to make changes. From my experience, however, the most effective changes are small — they’re incremental. When we overcompensate for an imbalance, we sometimes just make ourselves miserable in a different way.

This is the 11th of a 14-part series that explores my financial philosophy. These are the core tenets of Get Rich Slowly. Other parts include:

- Tenet #1: Money is more about mind than it is about math

- Tenet #2: The road to wealth is paved with goals

- Tenet #3: To build wealth, you must spend less than you earn

- Tenet #4: Pay yourself first

- Tenet #5: Small amounts matter

- Tenet #6: Large amounts matter, too

- Tenet #7: Do what works for you

- Tenet #8: Slow and steady wins the race

- Tenet #9: The perfect is the enemy of the good

- Tenet #10: Failure is okay

- Tenet #11: Financial balance lets you enjoy tomorrow and today

- Tenet #12: Nobody cares more about your money than you do

- Tenet #13: Action beats inaction

- Tenet #14: It’s more important to be happy than to be rich

Look for a new installment in this series every Monday through the end of the year.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)